-

· 2022广交会东莞澳门皇宫娱乐场展台 2019/11/27 · 澳门皇宫娱乐场在PVC管材挤出机生产线上的喷码应用 2018/5/31 · 东莞市澳门皇宫娱乐场有限公司户外春游活动取得决定性成功 2018/5/2 · 澳门皇宫娱乐场公司获得多项软件创新奖,用实力去改变行业 2018/4/13 · 2017/11/9 · 东莞伟迪杰将在食品包装展82E展位喷码机自动化参展 2017/9/19 · 东莞澳门皇宫娱乐场国庆放假通知 2017/9/15 · 东莞厂家收集激光喷码机为什么比墨水喷码机更少用 2017/9/4 -

· 东莞黄江澳门皇宫娱乐场与东鹏企业强强合作成功案例分享 2018/5/3 · 湖南喷码机的回收系统部件引发的三大疑问 2017/9/20 · 东莞伟迪杰推出性价比MINI迷你喷码机 2017/7/31 · 什么是性价比喷码机?澳门皇宫娱乐场 2016/9/23 · 不是所有的智能喷码机都是“智能" 2016/9/7 · 东莞制造业对东莞喷码机行业影响 2015/12/28 · 喷码机在散热片行业的灿发新光 2015/9/10 · 东莞喷码机市场营销重点在民营企业 2015/7/11 -

· 喷码机为什么逐渐会成为工业自动化主流 2017/8/5 · 东莞喷码标识行业需提升实力掌握主动权 2015/7/16 · 喷码机电磁阀——东莞喷码机厂家解说 2015/7/16 · 东莞喷码机耗材之---穿油膜墨水 2015/7/16 · 东莞喷码机的弱电信号抗干扰设计 2015/7/16 · 东莞澳门皇宫娱乐场成立培训委员会 重视人才培养 2015/3/31 · 3.1降价2000促销进口喷码机(东莞澳门皇宫娱乐场) 2014/3/6 · 10.10进口澳门皇宫娱乐场团购活动开始 2013/10/25 -

· 东莞伟迪杰带你解析喷码机墨盒的原理 2016/10/24 · 买喷码机看准东莞黄江喷码机厂家 2016/9/24 · 为什么要使用原装喷码机墨水?伟迪杰 2016/9/23 · 小字符喷码机优点与其他标识印刷设备对比 2015/3/31 · 移印丝印喷码简述及各自优缺点对比 2015/3/31 · 东莞小字符喷码机喷嘴的防堵设计 2015/1/12 · 喷码机标识技术的发展史 2014/5/4 · 智能型喷码机操作流程简介 2013/10/25

- 联系方式

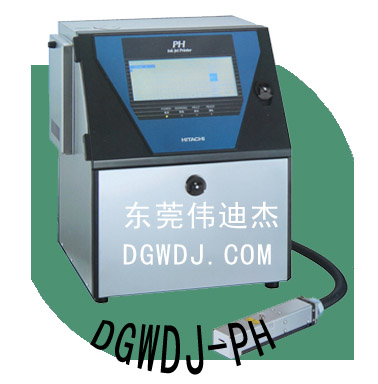

东莞富仕通喷码机位于东莞市莞樟路107国道,是集贸、工、技于一体的高新技术企业。 十多年来一直致力于品牌喷码机,自主研发喷码机及分页机、输送带、喷码耗材的推广服务。喷码机可广泛应用:食品、饮料、化妆品、制药、电子、电缆、汽配、建材、化工等行业,适用于各种材质的表面喷印。 秉承:“诚信、责任、专业、高效”的公司理念及丰富的行业经验、专业的工程师团队为客户提供全方位的喷码机解决方案。 售前服务: 1.依据客户产品特点及要求设计喷印方案 2.“高品质、高效能、低价位”的购机选择指导 售中服务: 1.设备...详细>>